March (Interest Rate) Madness

by Hodges Private Client Team, on Mar 22, 2022

The Federal Open Market Committee, or commonly referred to as “The Fed”, concluded their 2-day meeting on March 16. Coming out of the meeting they increased interest rates by 25Bps (.25 percentage points). With this announcement, there was an onslaught of news flow about what it all means. Many of our readers/listeners might have heard such statements:

- The yield curve is flattening

- The spread on the 2-10 yield is so narrow

- If they keep tightening, the yield curve will invert and that causes a recession

Before I dive in and provide you with some things that the media has apparently omitted from their typical fear mongering, let’s take a quick crash course in rates/lending/banking functions.

A bank takes in money from depositors and lends money to borrowers. Their goal is to make profitable loans, so they want to charge a higher rate to the borrower than the rate they must pay a depositor. That difference is called the net interest margin. As an example, if the bank pays you 1% on your deposits, but can charge a borrower 2%, the bank makes a 1% spread. So, the larger the net interest margin, the better for the bank. Make sense?

The net interest margin reflects a bank’s propensity to lend. The more profitable loans a bank can make, the better. Borrowers then take the money they’ve been loaned to fund their businesses, buy equipment, expand their operations…any endeavor where they can take the money and create a future economic benefit. As this is repeated throughout society, the economy prospers.

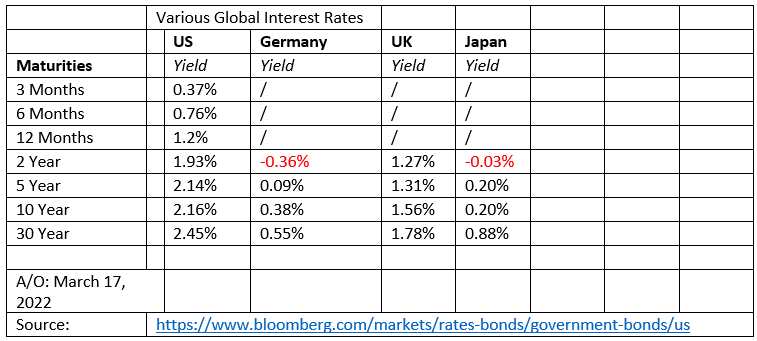

The worry du jour is that if the spreads between what a bank must pay a depositor vs. what they can charge to a borrower starts to shrink, it will therefore lower the expected net interest margin, and a bank’s propensity to lend will slow. There will be less loans in society, business can’t expand, purchase, hire, etc, and the economy will slow. The media keeps pointing to the spread between 2-year treasuries (currently 1.93%) and 10-yr treasuries (currently 2.16%) which equates to .23% positive spread.

So, then the media begins to extrapolate the “what-ifs”. What if The Fed keeps raising rates and there is no spread? Or what if they raise so much that short term rates become higher than long-term rates? My question is why are they fixated on just this one rate comparison? There are many different rates available. More on this in a moment.

What is the Yield Curve?

The yield curve is a slope that shows short-term interest rates (3 Months) to long-term rates (30 Years). So, let’s take a look at the bracketology below.

You’ll see that as the maturity (the length of the bond contract) increases, so does the interest rate, and the name for this is a normal sloping yield curve. Going back to the original function of a bank, its goal is to borrow shorter term, and lend longer term, and make a spread doing so.

So why is the media fixated on the 2-10 spread narrowing? Because it completes their narrative of negativity, pointing back to the three media sound bytes listed at the start of this write up. Look over here, not over there!

What is the media not discussing?

I feel that they’re missing two key points.

- Borrowing at the shorter end of the yield curve. There is nothing set in stone that a bank must borrow at 2 years and lend at 10 years. Being the profit seeking enterprises that they are, banks can borrow and lend anywhere along this curve.

- Borrowing from other countries. Over the past several decades, the world has become more tightly connected. Global banks can borrow in one country and lend in another. In the example above, US banks could borrow from Germany or Japan at much lower rates and lend back here in the US. There could be some differences in foreign exchange rates between these countries, but again, if there is a better net interest margin to be made, a bank will try to seek out that opportunity.

As far as future interest rate increases are concerned, I think it would be wise to evaluate the situation at each Fed meeting. They’ll be presented with more economic data in the future to make a decision about what to do at that juncture. I do not feel it wise to hang one’s hat on X amount of rate increase over Y amount of time, because things could always change in the interim. The Fed is a flexible entity.

*The above discussion is based on the opinions of Alan Ebright and is subject to change. It is not intended to be a forecast of future events a guarantee of future results and should not be considered a recommendation to buy or sell any security. Hodges Capital Management does not guarantee the accuracy or completeness of this commentary, nor does Hodges Capital Management assume any liability for any loss that may result from the reliance by any person upon any information or opinions herein.

Hodges Private Client is a program offered through Hodges Capital Management, Inc. (“HCM”). HCM is an Investment Advisory Firm registered with the Securities and Exchange Commission (“SEC”), is a wholly owned subsidiary of Hodges Capital Holdings and serves as investment advisor to the Hodges Funds. HCM is affiliated with First Dallas Securities, Inc, a broker-dealer and investment advisor registered with the SEC.

This discussion is not intended to be a forecast of future events and should not be considered a recommendation to buy or sell any security. Past performance is not indicative of future results. Investing involves risk. Principal loss is possible. Investing in smaller companies involves additional risks such as limited liquidity and greater volatility. No current or prospective client should assume that information referenced in this communication is a recommendation to buy or sell any security or is a substitute for personalized investment advice from your individual advisor. HCM does not provide tax or legal advice. Consult your tax or legal advisor for any related questions.

All information referenced herein is from sources believed to be reliable and is provided as general market commentary and does not constitute investment advice. This material was created for informational purposes only and the opinions expressed are solely those of HCM. HCM shall not in any way be liable for claims and makes no expressed or implied representations or warranties as to the accuracy or completeness of the data and other information. The data and information are provided as of the date referenced and are subject to change without notice.